Access 24/7 professional guidance from our experienced trading specialists.

Trade confidently, knowing expert support is always a call or click away, empowering your self-directed journey.

Trade cost-effectively with transparent, low commissions that match or beat competitors’ rates.

Our commission structure is designed with no hidden costs maximizing your profits. Scale your futures and options trading efficiently with pricing designed for your success.

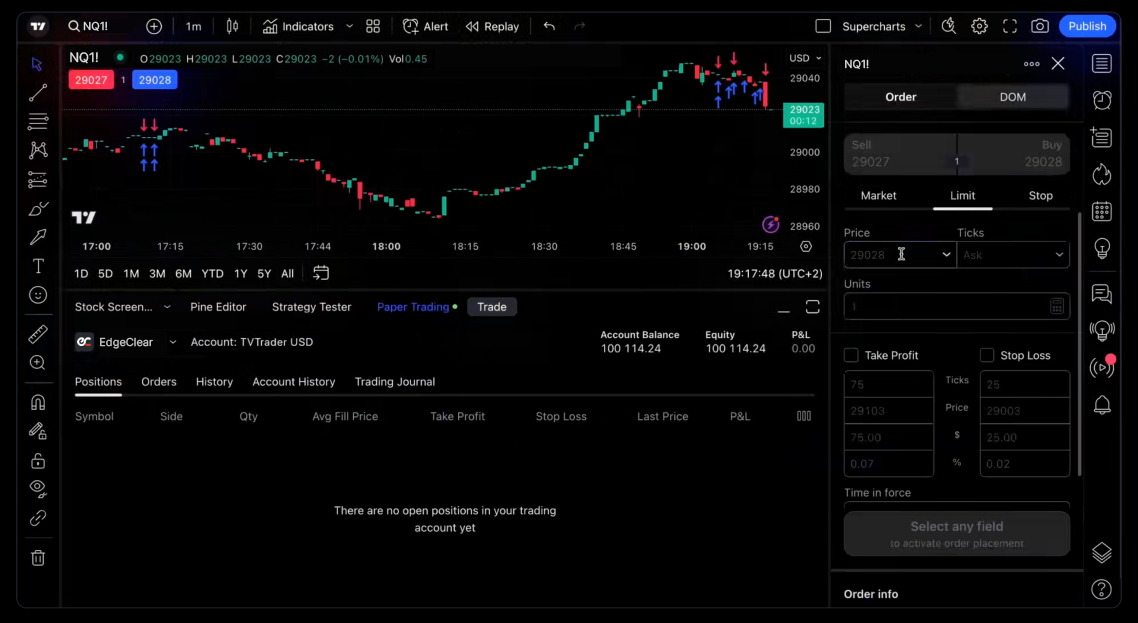

Leverage cutting-edge platforms with customizable strategies, real-time feeds, and advanced charting.

Our tools, tailored for futures and options, ensure precise, high-speed execution.

Stay ahead with technology designed to navigate dynamic markets effectively.

We offer a variety of trading platforms, including Lincoln Park Trader which is free for all customers.

Our full-service trading starts with your goals. Our brokers analyze market data, select futures and options contracts, set risk levels, and place trades on our high-speed platform, guiding you through planning, placing, and tracking with clear steps and real-time insights.

Create an account and verify your identity.

Fund your LPF account via Wire or ACH Bank Transfer.