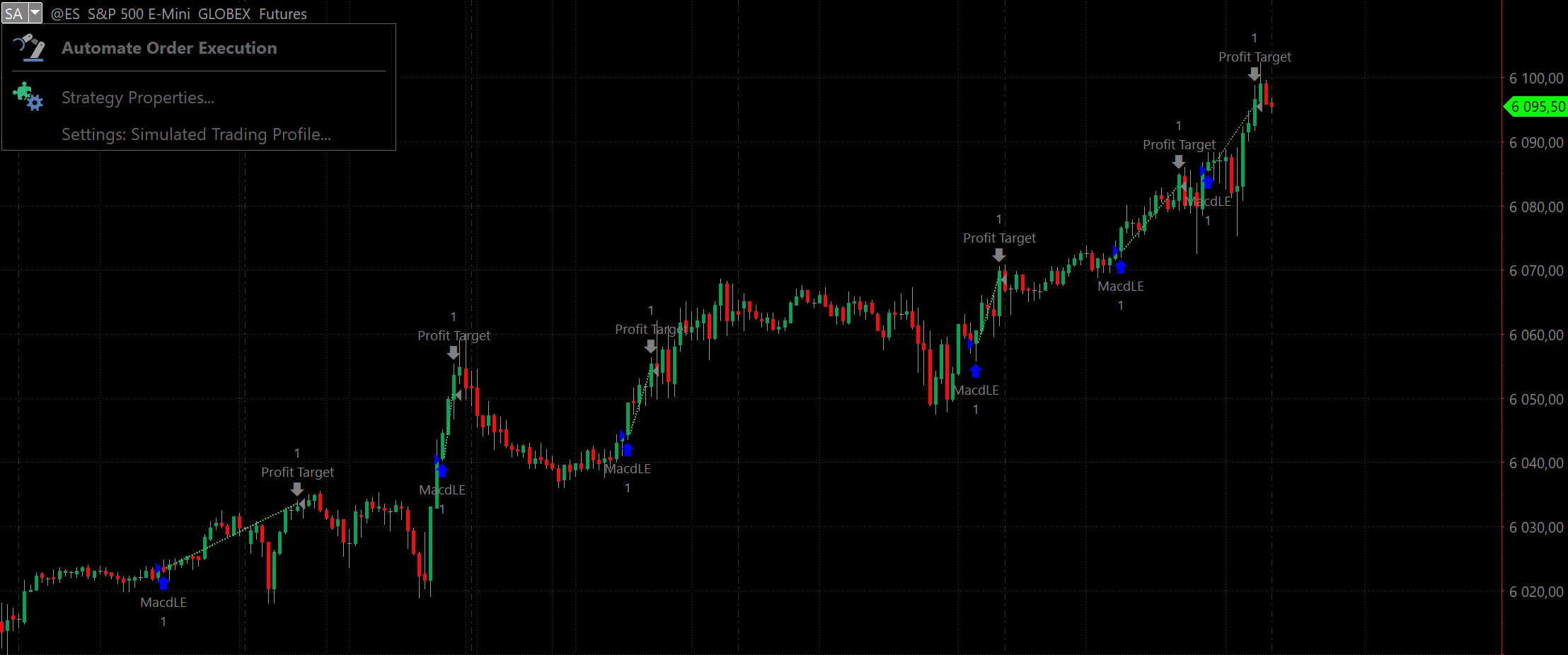

MultiCharts’ backtesting engine uses tick-by-tick data with multi-threading support, allowing traders to simulate strategies with historical accuracy and visualize results using customizable performance reports.

The Chart Trading Panel enables one-click or drag-and-drop order placement directly on charts, with intuitive stop, limit, and OCO order management, streamlining manual and automated trade execution.

MultiCharts’ PowerLanguage, allows traders to create or import custom indicators and strategies, with over 280 pre-built studies included for rapid deployment.

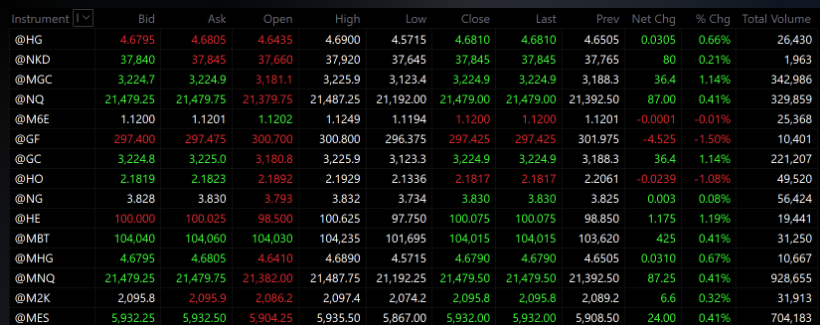

The Real-Time Market Scanner monitors thousands of symbols simultaneously, ranking opportunities based on custom criteria, enabling traders to identify high-potential trades across multiple markets.

QuoteManager acts as a bridge to store and manage historical and real-time data from providers like CQG, Rithmic, and Lincoln Park Financial, supporting seamless import/export and local data editing.

The Portfolio Trader tool tests multiple strategies across various markets or a single strategy on multiple instruments, delivering detailed performance metrics to optimize portfolio-level trading.