MotiveWave’s Auto Elliott Wave tool automatically plots and labels wave counts on charts, with adjustable decomposition levels and a scanner to identify patterns across multiple symbols, streamlining complex Elliott Wave strategies.

The Tile Windows feature organizes charts across multiple monitors by right-clicking the title bar, optimizing screen space and remembering layouts for quick setup, ideal for traders with extensive workspaces.

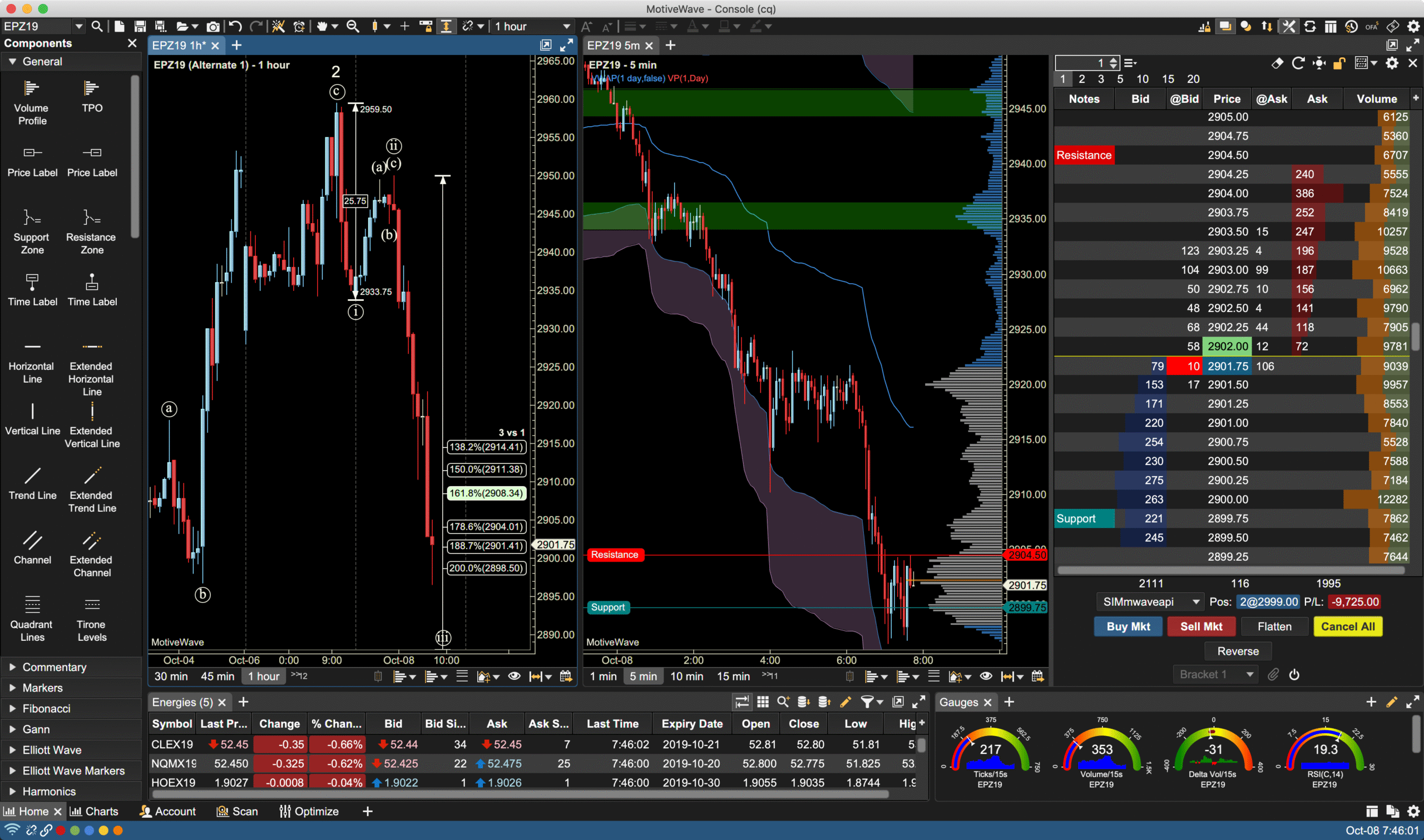

MotiveWave’s Advanced Depth of Market (DOM), available in higher editions, tracks bid/ask trade activity, pulling/stacking, and individual order sizes (Rithmic-only), with position-in-queue visibility for precise order flow analysis.

The platform’s strategy optimizer uses genetic and exhaustive methods to refine automated trading strategies, enhancing performance through backtesting and walk-forward testing without requiring custom coding.

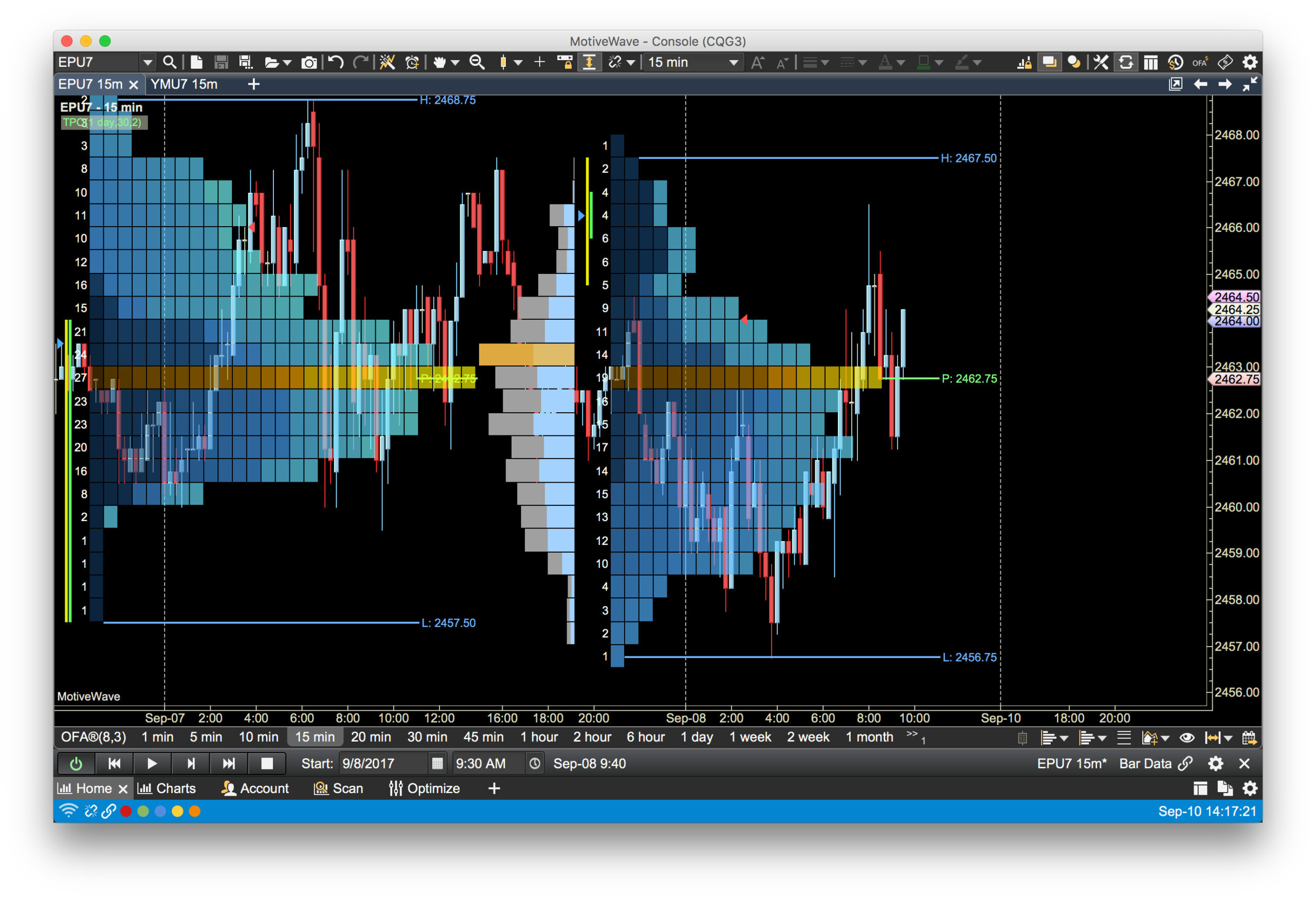

MotiveWave’s Order Flow Edition includes five Footprint chart types (Profile, Bid/Ask, Ladder, Delta, Volume), displaying volume distribution and key price levels to identify support and resistance.

MotiveWave Mobile’s tablet mode uses a docking framework to display multiple panels (charts, watch lists, DOM, Time/Sales), syncing with desktop workspaces for seamless futures, stocks, forex, and crypto trading.